Back in the USSR

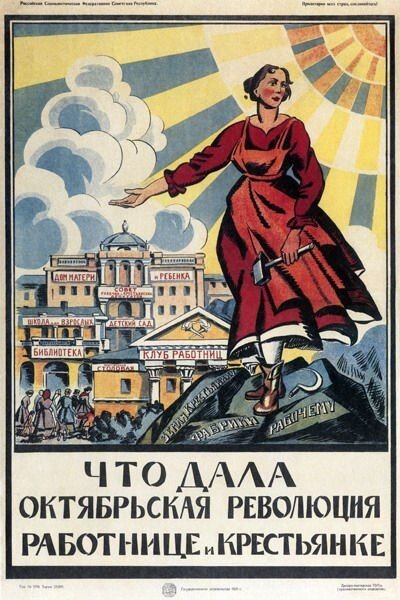

In my early career, I went straight from graduate school (developing country economics) to the frontier economies that had just been scattered like coins tossed in a desert after the collapse of the Soviet Union, or the USSR. I was active in Russia, Ukraine, and Latvia. These countries were privatizing, rebuilding and generally seeking integration with the global economy.

Suffering was palpable everywhere. The USSR’s currency, the ruble, was almost worthless. Prostitutes inhabited every block, knuckled over against the stabbing winds of Marxist dissolution. Late night gambling houses mixed cheap vodka and testosterone into a frenzy that cracked Moscow’s twenty-below night like lightning.

Youth and health were the only liquid assets. And that meant a huge portion society was permanently destitute. The equivalent in the U.S. would be the entire baby boomer generation slowly – and then suddenly – being wiped out and washing down cat food with cheap vodka. At the time, life expectancy for Soviet males was in the late 50s, or about twenty years lower than for a typical American male.

For more color on the former Soviet Union, read my creative non-fiction account of a trip to Riga, Latvia, an excerpt from Earth Tycoon.

I was in this wreckage working as banker to bring long-term financing to what was left of the Soviet oil and gas industry. Up until sometime in the 1970s, Russia’s centrally-planned economy was working ok. But as the rest of the world increased productivity through innovation, the Soviet’s top down command and control system failed in slow motion. Output fell and goods gradually became scarce. Marx described his brand of communism, or collective control of all assets, as a science. If he were alive today, Marx would likely use the word “technology.”

Now we know that denying an economy the dynamism of the human spirit when it comes leads to bad outcomes. Marx was truculent by nature, avoided thoughtful debate around the soundness and shortcomings of his theories and was exactly wrong on the point of innovation’s capacity to solve some of the flaws he observed in the nascent beginnings of the industrial revolution.

Similarly, the Soviets’ central planning methods saddled its economy with rigid thinking that relied on linear relationships between inputs and outputs. Information flowed vertically, not horizontally, and as entire industries faltered under the weight and din of party politics, the central planners leaned on the oil industry to plug the holes. Despite having abundant human capital, the USSR started a slow economic death beginning in the 1980s. I got a sense that the education system selected for two narrow features: capacity to memorize and compliant sensibility; not only because these traits have some value to Soviet society but also because it was an easy way for a lazy, overburdened education system to meet centrally-planned objectives.

The problem was that oil exposed the country to excessive reliance on a commodity that had a tendency to rise, thereby yoking the ruble higher. And then the inevitable crash would take the currency down with it. The oil curse spread like venom through the brittle centrally-planned economy. If it weren’t for the lottery winnings provided by oil, the USSR would have remained an advanced agrarian economy. Instead, its industrial economy cratered, leaving millions to suffer a shortened, diseased life that was preventable.

Central planning explains how an experimental reactor got constructed with a tin roof as protection from meltdowns. Chernobyl’s budget was a function of 1) hubris that the Soviet system could afford to build safe, new reactors (it could not); 2) unreviseable allegiance to the communist political party that accused skeptics of disloyalty.

The oil transactions I worked on in Russia in the early 1990s (greenfield and well work-overs) revealed the failings of the oil and gas industry in the 1980s. Bankers like me hire geologists to evaluate certain properties of oil fields. One key factor is lifting costs or the cost of production on a per barrel basis (each oil field is unique in this regard), and this is often a function of the natural pressure that exists deep in the geological recesses of the field. The question we needed to answer was whether the qualities of the oil field, such as natural pressure and the quality of the oil itself, corresponded with our assumptions for the project’s capacity to repay interest and principal over the period of the loan. Our focus was on the unit economics, not ideology. In some cases, our geologists were able to obtain historical records from the 1980s. They showed how the central planners squandered the oil field’s natural pressure to increase short term production in exchange for ensuring very poor (high) lifting cost in the future. When pressure is insufficient, oil drillers have to inject a lot of costly, nasty substances down in the oil field to create artificial pressure.

Today the US central bank is like the modern Siberia for financial assets that do not adhere to the central planners’ prescribed idea of price stability. The Soviets sent intellectuals and artists to remote parts of Siberia when their beliefs conflicted with Marxist ideology. Similarly, the forced settlement of assets within the confines of the U.S. Central Bank is nothing more than internal exile based on criteria arbitrarily decided upon by a central committee of unelected people who probably have a political agenda. They will tell you it’s all for the good of the people, and the quieting of the sensory organs of capitalism is consistent with the mood of the gods.

Put aside the question of why a central planning committee needs to accumulate $7 trillion of assets (as of 2020) over an eleven-year period in a free market economy, and instead ask the question about the output of such long emergency actions. We know the central planners’ focus is on the inputs: a growing variety of securities that started with treasury and agency securities designed to manipulate interest rates, then mortgage securities based the last bubble blow up, and now low-grade corporate credit in the arena of the current bubble blow up resulting from massive corporate leverage. There will be more. And the reasons will slide towards party politics. And securities will be created for the sole purpose of exploiting the central bank’s doctrine of omnipotence.

Most concerning to me as a risk manager is the likelihood that the output from all these centrally-planned securities purchases serves to suppress volatility and otherwise distort the true risk picture. The underpinnings of risk management and finance theory in general provides that historical volatility in a asset prices is indicative of future risk. So what happens when the central planners manipulate the yield curve and interest rates for decades and then intervene in private markets by targeting securities that are misbehaving (ie. responding to risk by becoming more volatile). The most recent interventions include risky assets like BBB bonds and junk bond ETFs. Add distortions to relationships between these asset classes (correlations) to the second- and third-order impacts of central bank actions. The Soviets jailed people for “agitation and propaganda,” and we are jailing assets for the same. The current period seems to be evolving towards a Great Compression.

Equity investors often measure risk by tracking the performance of a company’s bonds, among other things. This is because bond investors are sensitive to default risk. Bonds trading below 85 or 90 cents on the dollar, for example, signal the potential for default and therefore low and/or negative equity returns. Studies show this relationship is strong. Common sense does too. Central bank actions to insert systematic bias in the purchase of debt securities of highly levered companies erodes the value of these long-held relationships. Confirmation of this erosion should lead to a wider dispersion of returns in the equity securities of companies with risky levels of debt. Could insolvency become a buy signal for equities?

Performing a historical regression analysis of securities prices containing only the securities that the central planning authorities have blessed through systematic bias reduces the predictive value of such methods because the other securities, the ones in exile, no longer send their risk signals to the market. What does this mean for fiduciary duty? It means investors must include U.S. political risk in risk budgets. What are the risks that the U.S.’s global reserve currency could be a type of natural resource lottery ticket used to plug holes elsewhere in the economy? China is working on currency alternatives.

The ideas presented in this post do not constitute a recommendation to buy or sell any security.

Investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is not indicative of future price action.

You should be aware of the risks involved in stock investing, and you use the material contained herein at your own risk. Neither SIMONSCHASE.CO nor any of its contributors are responsible for any errors or omissions which may have occurred. The analysis, ratings, and/or recommendations made on this site do not provide, imply, or otherwise constitute a guarantee of performance.

SIMONSCHASE.CO posts may contain financial reports and economic analysis that embody a unique view of trends and opportunities. Accuracy and completeness cannot be guaranteed. Investors should be aware of the risks involved in stock investments and the possibility of financial loss. It should not be assumed that future results will be profitable or will equal past performance, real, indicated or implied.

The material on this website are provided for information purpose only. SIMONSCHASE.CO does not accept liability for your use of the website. The website is provided on an “as is” and “as available” basis, without any representations, warranties or conditions of any kind.

Leave a Reply