Musk Brings Enormity Back To The Speculative Genre

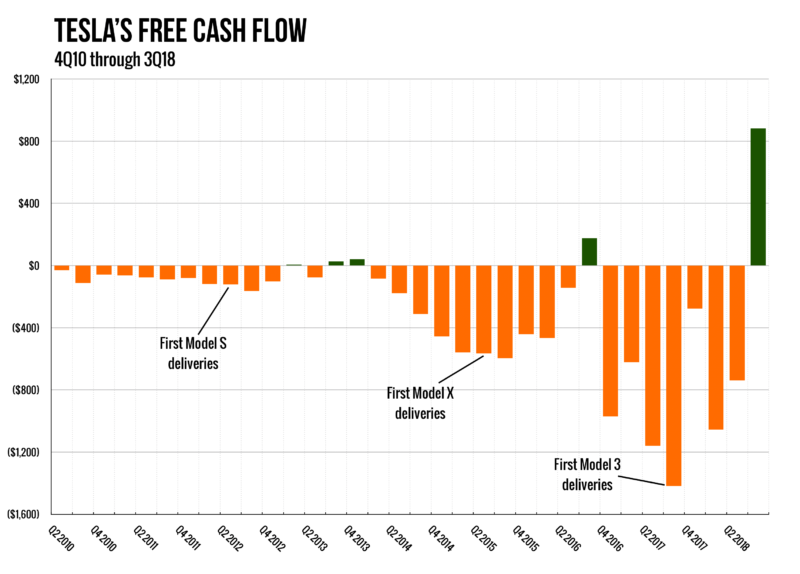

Elon Musk’s Tesla, Inc probably could not have happened without the monetary corruption of various forms in the last 10 years, but it did, and while there are many zombie companies floating around today based solely on low-cost debt, Tesla, one part of Elon Musk’s grander vision, will emerge as a dream with a mission too vital for any living person to ignore. Musk’s unconventional style has been interpreted by some analysts and short sellers as a case of misplaced faith in a dreamy cult figure guiding unquestioning followers into the abyss. I argue that the real boogeyman is much better dressed and has an aesthetic of stylized cinematic gloss and the trappings of realism: the nameless, faceless and infinitely blameless General Motors (GM) executive who is both boring and dangerous at the same time. While GM rehearses for its next bankruptcy, there are a constellation of signals (quantitative and qualitative) pointing to the potential for VC-like returns in Telsa’s stock in what makes it one of the best high-risk investments of a lifetime.

Comparison with General Motors

What villains provide for heroes is a sharper vision of what makes the hero a hero. And in this saga, GM is the best kind of villain for Musk and a tragedy for free market capitalism. I’m referring to the dulled senses and immersive delusions perpetuated by a set of perfectly-coiffed GM executives who trafficked in the lamest pop-corporate dead end clichés like “strategic planning” and “R&D” for decades while the company’s market share fell from 52% in the 1960s to 22% in 2008, the year it filed for bankruptcy. In fact, the company had lost $100 billion in the five years leading up to its bankruptcy. The same executives then axel-greased their way into a politically engineered $50 billion government bailout hidden behind the moral smokescreen of “jobs” and “Made in America” and (most comical of all) “electric vehicles.” Posthumous reports revealed the government approval of at least $1 million in pay for each of the top 25 employees at both G.M. and Ally (GM’s financial arm) and the approval of $3 million in pay raises for nine G.M. employees. The value of GM’s bankruptcy/bailout was equivalent to Tesla’s current market cap.

It’s impossible to imagine Tesla’s entrance on the stage as a fledgling startup without acknowledging GM’s role in providing vivid contrast as the toyish back-projection screen that is visible in the rear view mirror of every Tesla automobile today. Cleansed of debt via bailout/bankruptcy, GM’s corpse (reborn out of experiments with electricity?) emerged from its torpor into a competitive marketplace in 2010 to menace its industrial neighbors that were unafforded the same magical balance sheet cleansing. It thus completed a story arc containing make-believe worlds like the clinging-to-life gimmickry of free market capitalism in the automobile industry – and a rejection of the whole notion of consequences. It also provides yet another example of U.S. corporate welfare that actually subtracts vast amounts of value by privatizing gains and socializing losses – but only after the politicians’ re-election. A few years later, the newest myth about the government’s wisdom in directing private, corporate bailouts exploded when the GM “investment” became a permanent loss, an outcome even the Soviets would have been jealous of. Taxpayers came up short because the U.S. decided to buy GM stock to keep the automaker alive instead of giving it a loan and saddling it with more debt. Sure enough, in the five years following its bankruptcy GM made $22.6 billion for shareholders. One fact that makes the irony so explicit: taxpayers still lost $11.2 billion on the bailout that saved the company. Such an outcome’s power only comes from our capacity to sustain the illusion.

Banks, automakers and other companies that received most of the $700 billion TARP bailout money in 2009 had spent $114 million on lobbying and campaign contributions just a few months prior to passage of the bailout legislation. In the midst of the GM bailout, Musk found himself out of cash and borrowing money from friends to make payroll for having put all his cash (at least $200 million) into Tesla’s launch during a economic crisis brought about by the same forces at work with the GM gimmickry.

Obama climbs into a Chevy Volt with staged emotion in 2010. The breezy artifice of “progress.”

Grubby reality does have the potential to undermine Musk’s industrial glamour, but I’m inclined to give Musk some latitude for his short-sellers-as-shrapnel mentality because his sometimes truculent style reminds me that there is real blood coursing through his veins and that he is not just another quasi-dead U.S. auto manufacturing executive with a fancy MBA and a private jet shuttling between Detroit and Washington, DC three times a week. After witnessing Musk’s shaping of Tesla and related entities since 2012, I believe his well-publicized scrapes and outbursts are more about a connection to his substance than to some underlying instability. Musk’s densely-textured vision of what needs to happen if we humans are to address our infinite appetite for consumption against the backdrop of finite earth resources forces our perception to simultaneously pull back and zoom forward, the way Musk’s experimental spirit sees the world, in a temporarily disorienting warp from super-orbital to subterranean that is anything but rigged to getting us there. It’s like seeing the ragged truth through the lens of video versus the doctored world of celluloid. Musk’s looks-like-he-was-born-tomorrow persona translates into a risky investment but not one rigged with political graft and perpetually declining market share. Musk’s Tesla is what the largest U.S. corporations should aim to be at least in terms of the enormity of problems that need solving, but I fear the special effects that propped up the GM horror drama is what too many U.S. corporations are most like.

Musk’s Many Projects

In addition to Tesla, Musk founded SpaceX, a leading aerospace manufacturer and space transport services company, of which he is CEO and lead designer since it was founded in 2002. Telsa recently acquired SolarCity, the largest installer of rooftop solar systems in the U.S., making Musk its chairman. (Musk invested in SolarCity when it was a startup). In December 2016, Musk founded The Boring Company, an infrastructure and tunnel-construction company presently completing its first tunneling project in Los Angeles aimed at relieving traffic congestion. Watch the world’s first reflight of an orbital class rocket as Musk’s SpaceX SES-10 takes off and lands on a drone ship in the middle of the Atlantic ocean.

Tesla As A Speculative Investment

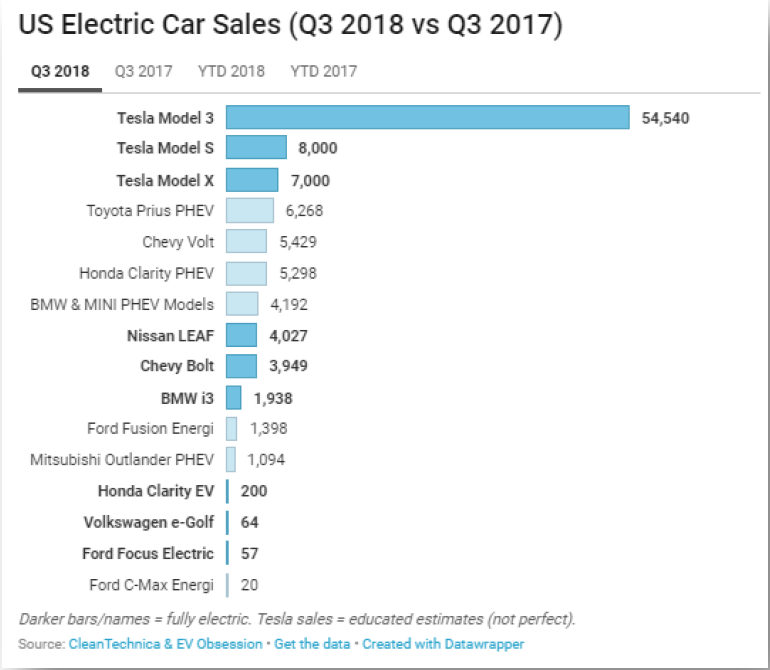

To speculate in Tesla is to see a narrative emerging from the periphery where awareness of one aspect of Musk’s businesses does not automatically deepen the others if all your points of identification are historical and not future. The narrative that is alive today is much less about meandering through loosely interlocking stories but one that shows Tesla fitting into a larger plan with clearly defined inflection points that Musk has been articulating for years. The most recent quarterly announcement shows how the plot is evolving according to a thoughtful script. The spark of Musk’s vision for Tesla could trigger a fundamental economic transformation around energy and transportation. Tesla’s total addressable market (TAM) is 10-15x relative to where it stands today, and the inflection point with Model 3 means the story is transitioning from proof-of-concept to a focus on TAM.

Telsa, often misunderstood as a maker of very fast, battery-powered cars, is actually a transportation and energy company. It sells vehicles under its Tesla Motors division and stationary battery packs for home, commercial and utility-scale projects under Tesla Energy.

Tesla is the only company on earth with direct, combined exposure to: artificial intelligence (AI), robotics and battery tech. And it is the most shorted stock in U.S. markets by market value. Of Tesla’s $55b market cap, $11b is short, or about 32 million shares.

Battery Tech

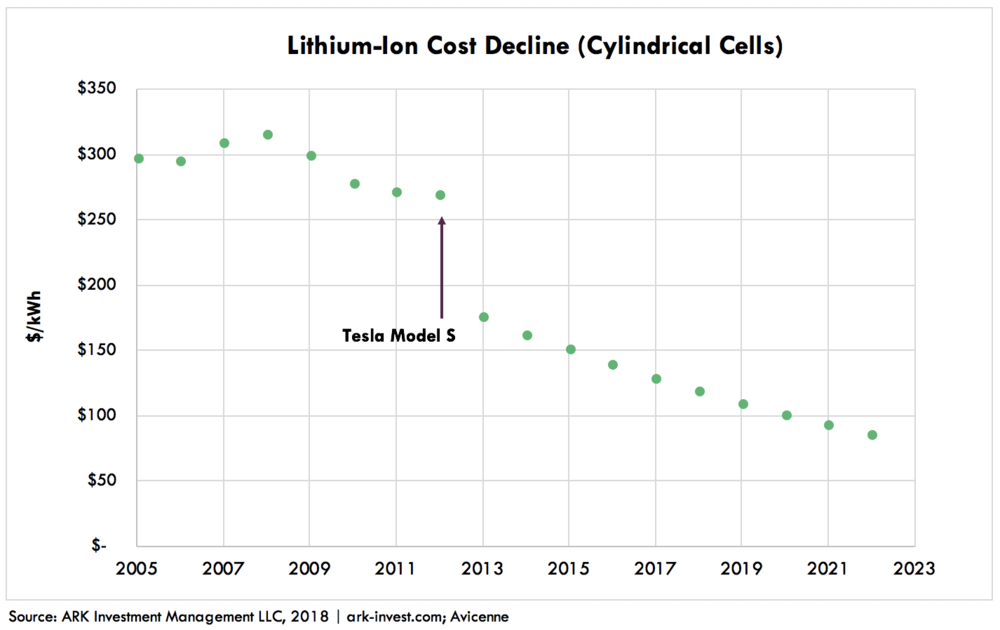

Tesla is 2-3 years ahead of competitors in terms of being able to monetize the scale efficiencies presently at work in battery tech for electric vehicles (EVs). Each new model cycle brings Tesla in closer touch with mass markets for EV vehicles – and parallel free cash flow. Today’s Model 3 battery pack uses Tesla’s next generation 2170 cells (21mm width, 70mm height) that contain about 33% more energy when compared with previous generation 18650 cells – and this applies favorably to competitors’ cars as well. GM claims it is currently buying battery cells from LG Chem for the Chevy Bolt EV at $145 per kWh. Audi claims it is buying batteries at $114 per kWh for its upcoming e-tron quattro that has yet to launch. Musk sees Tesla achieving $100 per kWh for the overall battery pack in less than two years. Musk also added that he sees Tesla achieving a 30% improvement in volumetric energy density within 2-3 years using current proven technology that “needs to be scaled and made reliable.” New data contained in a report by UBS estimates that Tesla’s Gigafactory 1 (GF1) battery cell costs are $111 as compared to the next best producer, LG Chem, with production costs of $148 – undermining Audi’s claim of $114. These cost efficiencies at GF1 are key to delivering the base-model Model 3 with a target retail price of $35,000.

Such an improvement in volumetric energy density would mean that Tesla could, for example, fit 130 kWh of energy capacity in its current Model S and Model X 100 kWh battery packs and push the range of those vehicles over 400 miles on a single charge, far higher than any competitor can achieve over the same time period. The thirst for battery innovation finds its peak when the end result has a built-in market with known economics, so Tesla is proving it can innovate in energy storage technology better than other stand-alone battery tech companies hoping to sell its product to third parties.

Tesla’s GF1 is the highest volume and lowest cost producer in the world. It produces more battery capacity than all other car manufacturers combined, including China, with a run rate of approximately 20 gigawatt-hours. The factory is nearly 100% automated.

This vital edge in owning the best scale advantage in battery efficiency means Tesla’s cars will remain ahead of the pack for a long enough duration to create whole new model cycles of cars and trucks that are the most sensitive to market demand/preferences and that also include the best technology. In the near term, this “cycle advantage”, or faster commercial metabolism, is vital for tech products experiencing rapid evolution on top of product/market fit. Longer term, ride sharing trends may be enough to shrink auto demand far enough to wipe out GM and Ford, yet Tesla is immune, or perhaps even empowered, by this dynamic.

Direct-to-Consumer

Tesla is the only automaker that sells cars directly to consumers. In the U.S., direct manufacturer auto sales are prohibited or restricted in some way in almost every state by franchise laws requiring that new cars be sold only by dealers. Such anti-competitive laws are perpetually enshrined though vigorous state-level political “donations” from the auto dealership lobby cabal. Here are the states that currently ban Tesla dealerships: Alabama, Arkansas, Connecticut, Iowa, Kansas, Kentucky, Louisiana, Michigan, Montana, Nebraska, New Mexico, North Dakota, Oklahoma, South Carolina, South Dakota, and Texas. (Note: A State of Michigan retirement fund profited $22m from the sale of 269,000 shares of Tesla in 2016.) Yet in 2013, when the Model S rolled out, Consumer Reports released its official rating and called it the “the best car it has ever reviewed.” As Tesla’s lineup of mass market cars expands, U.S. consumers will eventually demand access to Tesla’s cars in their home state.

The Lineup

Tesla’s current auto/truck model lineup includes: ultra-luxury sports/performance cars (2020 Roadster, quickest and fastest on earth, 0–60 mph in 1.9 seconds – it also will achieve 0–100 mph in 4.2 seconds, and the top speed will be over 250 mph (400 km/h)); mass market sedan (Model 3, in production); SUV (Model X, in production); and Tesla Semi (coming soon). With its new batteries, the Semi will be able to run for 400 miles (640 km) after an 80% charge in 30 minutes using a solar-powered “Tesla Megacharger” charging stations and 500 miles (805 km) range on a full charge. Musk said that the Semi would come standard with Tesla Autopilot that allows semi-autonomous driving on highways. Finally, Musk has commented recently that he would like to see a Tesla pickup truck on the market next year, perhaps simultaneously with the undefined Model Y that is expected to be a sedan similar to the Model 3 but with premium features.

Tesla’s Semi has a potential competitor in startup Nikola Corporation. While the two companies are locked in a patent dispute that appears to be unpromising for the new startup, a recent Round C capital raise points to an interesting claim by Nikola: it has $12 billion in pre-orders for its hydrogen-electric truck designed for the European market. This surge in orders appears to be a response to new policies by the E.U. aimed at reducing CO2 emissions by 15% by 2025, with further reductions slated at a later dates. Trucks and buses contribute about 25% of total CO2 emissions in the E.U.

Comparing Tesla to Apple

Tesla and Apple share a remarkably similar narrative, as outlined extensively by ARK Investment Management. Both companies sell hardware differentiated by a unique user experience made possible by deep vertical integration. Both companies thrived under the leadership of an uncompromising and often unpredictable CEO. Both have been ridiculed for being different, have been put on “death watch”, and have attracted the scrutiny of the SEC. Yet both companies have delivered when it matters most—making products that competitors can’t match and that customers camp out overnight to buy.

Tesla resembles Apple in three key areas: a strategy of vertical integration (which includes component production and proprietary charging infrastructure), an imminent product inflection (Model 3), and a business model transitioning from hardware to services.

It’s hard to overstate the significance of cost declines that make the Apple analogy work: the transition to mobile computing destroyed the moat around the PC ecosystem that had been built over decades—what mattered was, “Who is best at mobile?” Likewise, the transition to EVs will obsolete decades of gasoline power technology—the key question becomes, “Who has the best electric platform?”

With an installed base of cars and control of the customer relationship, Tesla will enjoy different opportunities which could prove more lucrative. The most valuable asset that Tesla’s installed base generates is data. On this metric, Tesla has no peer, thanks to its advanced sensor suite installed across roughly 400 thousand vehicles gathering roughly 4.5 billion miles of data per year. In the coming weeks, Tesla’s fleet of vehicles is expected to hit 10 billion electric miles with a fleet size of 500,000 vehicles. This includes more than 1 billion Autopilot miles. And in its home state of California, Tesla’s recent surge in sales has pushed the all-electric vehicle market share to 4%.

Artificial Intelligence

In October of 2018, Musk announced that Tesla’s new custom AI chip is about six months away from being installed in new production cars (and will be a free upgrade for existing owners who paid for Autopilot). Musk suggested the new AI chip, customized for running deep neural networks, will improve autonomous driving performance between 500-2000% and allow it to advance beyond Google’s current slight edge in AI for autonomous vehicles. Based on a tear down by a Tesla owner and specs from Nvidia, HW2 is capable of around 10 trillion deep neural network (DNN) operations per second or 10 DNN teraops.

Tesla began developing its own hardware after it split with its previous partner Mobileye two years ago. If HW3 is 10x more powerful than HW2, then it should have around 100 DNN teraops. Tesla’s HW3 will have about 4x as much computing power as Mobileye’s EyeQ5, about the same as what Google found “pretty compelling” in August 2016. In 2017, Google stated its self-driving cars had driven a mere 4 million miles on public roads, with another 2.5 billion simulated miles.

Datasets

Researchers at Google note that academic and industrial experience with neural networks has been limited to relatively small datasets. The ImageNet training dataset, for example, comprises 1 million images. But Tesla’s fleet of approximately HW2 cars has the capacity to capture billions of images. While ImageNet contains 1,000 categories of objects, a self-driving car might only deal with about 200 categories of objects. So a training dataset of 5 billion images wouldn’t just have 5,000x as many training examples. It would have 25,000x as many training examples per object category. The neural network architectures that are well-suited for datasets in the millions are suboptimal for datasets in the billions. Tesla’s new, bigger architectures, combined with its massive fleet of cars, will propel the company ahead of Google in a race that is highly dependent training AI tech using actual miles driven.

Mobility-as-a-Service

If it succeeds, Tesla’s Mobility-as-a-Service (MaaS) network could contribute roughly 80% to Tesla’s enterprise value, according to ARK Investment Management. MaaS has the potential for Tesla owners to turn their cars into automated “Ubers” and capture substantial per-mile savings. The scale of its fleet and data gathering gives Tesla a serious shot at becoming the first company to deploy fully autonomous driving at scale. Incidentally, recent reports suggest Uber is preparing for a $120 billion IPO next year at a valuation that is more than twice Tesla’s market cap today.

Autonomous capability sets Tesla up for Part II of the Master Plan it laid out by Musk in July 2016—the transition from hardware to transportation on-demand:

When true self-driving is approved by regulators, it will mean that you will be able to summon your Tesla from pretty much anywhere…You will also be able to add your car to the Tesla shared fleet just by tapping a button on the Tesla phone app and have it generate income for you while you’re at work or on vacation, significantly offsetting and at times potentially exceeding the monthly loan or lease cost…In cities where demand exceeds the supply of customer-owned cars, Tesla will operate its own fleet, ensuring you can always hail a ride from us no matter where you are.

~ Elon Musk

China

In July 2018, Tesla signed a deal with Shanghai authorities to build its first factory outside the U.S., which will double the size of its global manufacturing and lower the price tag of Tesla cars sold in the world’s largest auto market, starting with the Model 3. China is also the largest EV market with sales topping 1 million units this year. According to Reuters, the factory will add domestic supply to China’s rapidly growing market for so-called new-energy vehicles (NEVs), a category comprising electric battery cars and plug-in electric hybrid vehicles, even as China’s wider car market softens. Starting in 2019, major manufacturers will be punished for failure to meet quotas for zero- and low-emission cars (or to buy credits from other companies that exceed the quotas). The cap-and-trade system is designed to accelerate the market for electric cars at the expense of traditional all-gas cars and is part of China’s quest to clean its air and reduce dependence on imported oil. Tesla has previously said that it would raise capital from Asian debt markets to fund the construction, which will cost about $2 billion.

In China, only 20% of the population has a driver’s license, compared to 70% in the U.S. Autonomous vehicles are likely to bring a substantial share of this population into the point-to-point mobility market given the much lower total cost of usage compared to car ownership. China could become Tesla’s first fully autonomous driving at scale within a few years, giving it a massive advantage in AI deployment in a real-world environment.

Summary as of October 2018 by Citron Research:

• Tesla will, finally, after 10 years of unprofitable existence, have the ability to prove that it can be a sustainable, highly cash flow generative entity that is no longer reliant on the capital markets.

• A strong quarter removes the overhang of a necessary capital raise – we suspect that Tesla will be generating more than enough cash to both fund aggressive growth plans and build cash on the balance sheet.

• It transitions Tesla from a “proof of concept” story to a “TAM / how much can this grow” story, attracting a whole new growth-oriented investor base.

• It makes the bear case solely about Valuation and Demand.

• Short interest is at the same (high) level as five years ago though risk is heavily skewed to the upside in the near-term. Even if Tesla does not meet its profitability goals, it is well funded and long-term shareholders will look towards:

• Secured an agreement to build a wholly owned Shanghai facility (Note: this was the first time China let a foreign automaker open up shop without a Chinese company as its partner)

• The entrance of Model 3 in the European market

• New factory to be constructed in Europe

• Possible resolution to US / China trade war (and subsequent dropping of 40% tariffs)

• Tesla Semi truck production announced

• Tesla added to S&P (likely an April 2019 event)

• Model Y Unveil (March 2019)

• Q4 deliveries and earnings far in excess of consensus

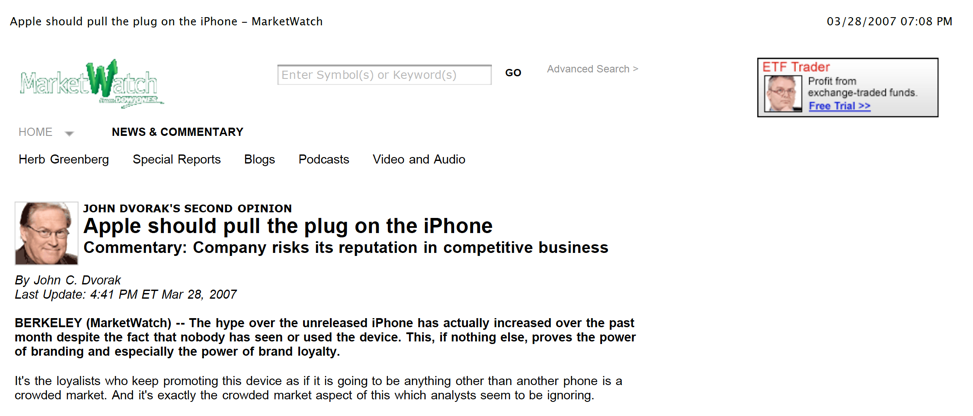

Here’s an article about Apple written in 2007 by a well-known business columnist. I printed and saved it as an artifact to remind me when a chorus of venomous doubters gun for ruin when faced with big ideas.

Bill Gates appeared next to Steve Jobs to create split-screen twin view of a massive shift in technology with great social implication, a vision that coalesced to make Apple the most valuable company in history. Bill Gates himself publicly wrote off the iPhone only to witness it, a single product, become bigger in sales than Microsoft. Something similar is going on today with Elon Musk, with GM standing in as his “Bill Gates” in another split screen drama, and just in case we put too must trust in a single image, GM provides a defining angle amid the shifting vantage points of Musk’s epic action drama.

The ideas presented in this post do not constitute a recommendation to buy or sell any security.

Investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is not indicative of future price action.

You should be aware of the risks involved in stock investing, and you use the material contained herein at your own risk. Neither SIMONSCHASE.CO nor any of its contributors are responsible for any errors or omissions which may have occurred. The analysis, ratings, and/or recommendations made on this site do not provide, imply, or otherwise constitute a guarantee of performance.

SIMONSCHASE.CO posts may contain financial reports and economic analysis that embody a unique view of trends and opportunities. Accuracy and completeness cannot be guaranteed. Investors should be aware of the risks involved in stock investments and the possibility of financial loss. It should not be assumed that future results will be profitable or will equal past performance, real, indicated or implied.

The material on this website are provided for information purpose only. SIMONSCHASE.CO does not accept liability for your use of the website. The website is provided on an “as is” and “as available” basis, without any representations, warranties or conditions of any kind.

Leave a Reply